change in net working capital dcf

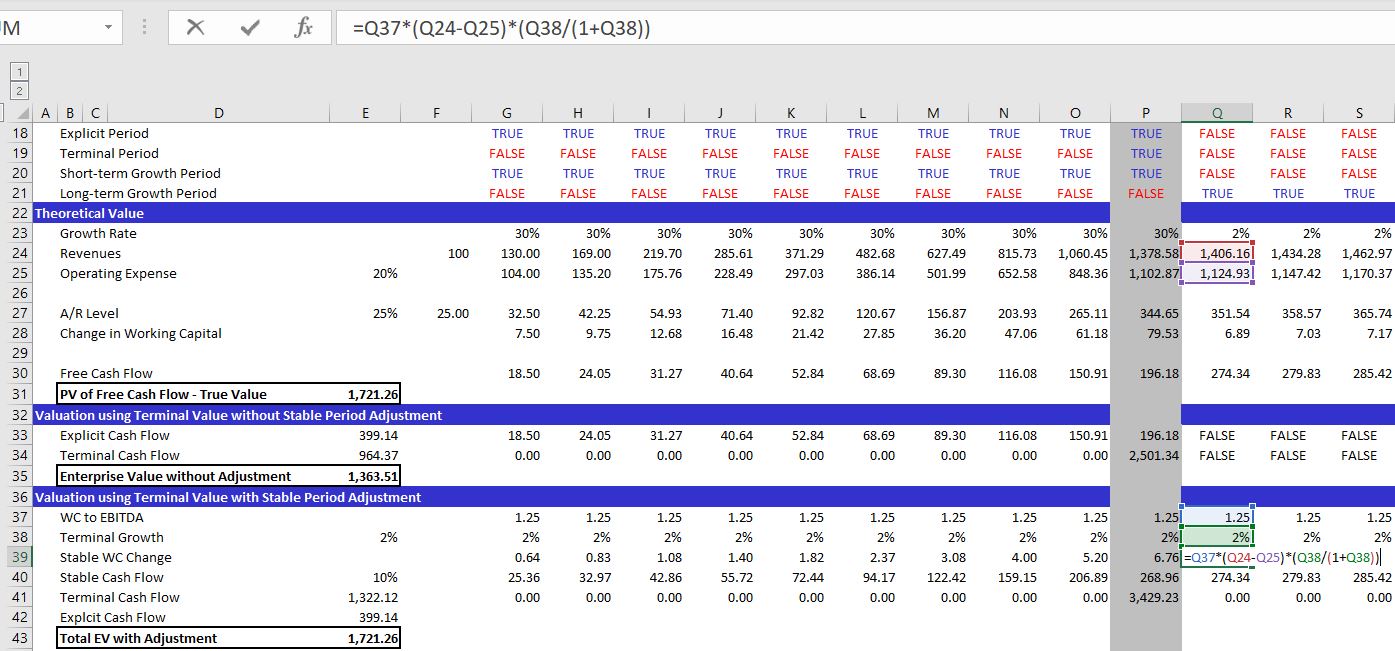

This article describes adjustments that should be made to terminal cash flow that is used to derive terminal value. Since the change in working capital is positive you add it back to Free Cash Flow.

Negative Working Capital Made Easy The Ultimate Guide 2021

You used to keep 100 cups on your.

. Subtle difference with the one above. A change in working capital is the difference in the net working capital amount from one accounting period to the next. These changes can signal the management about improvements that should be made such as product.

It is the combination of current assets and current liabilities that the company uses for. Working Capital changes would affect the cash flow in following ways. Free Cash Flow to The Firm FCFF Interest Paid Net of Tax.

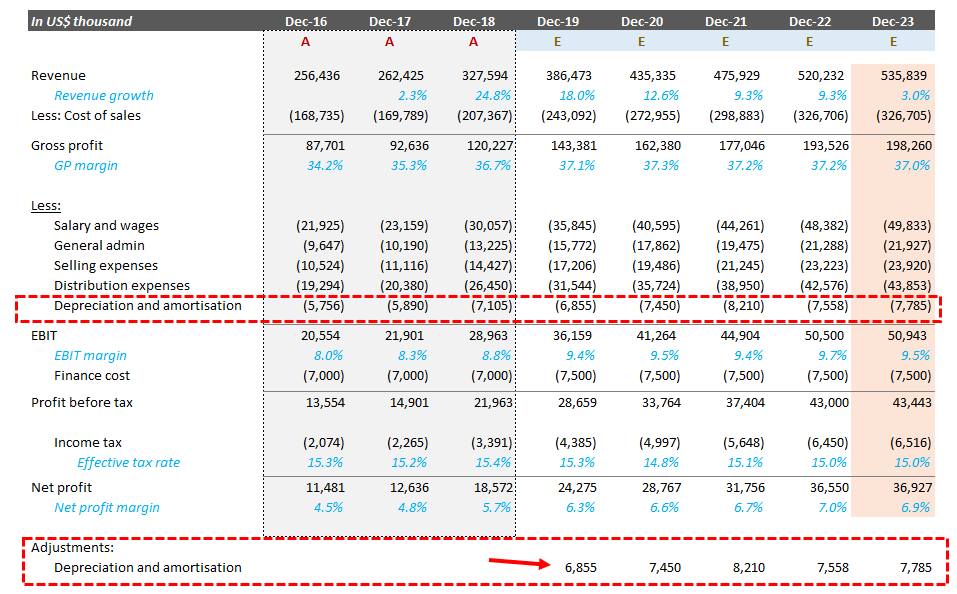

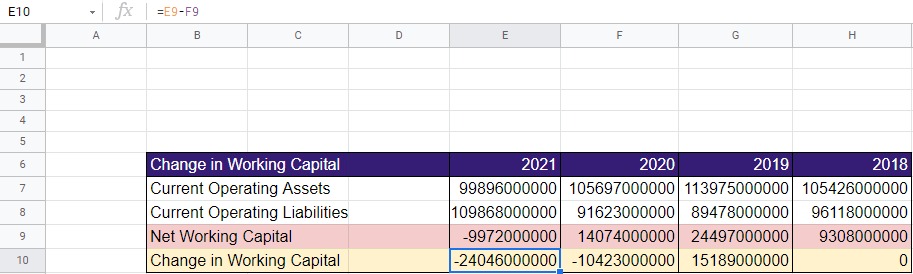

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future. Helping Donors We partner.

Working capital is one of the engines that drives a business to profitability and growth. In here you want to substract Current liabilities net of debt to current assets net of cash. The goal is to.

Calculate the change in. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current. Change in Working Capital Summary.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous. Net changes in working capital are adjusted in the free cash flow projections to arrive at the free cash flow figure. Thats why the formula is written as - change in working capital.

The Change in Working Capital tells you if the companys Cash Flow is likely to be greater than or less than the companys Net Income and how much of a difference there will be. Normalised Cash Flow in DCF Working Capital Taxes and Stable ROIC. Changes in working capital are presented in the companys cash flow statement.

Lets say you expect business to kick up over the next year. Change in Net Working Capital is calculated using the formula given below. Relevant Cash Flows for DCF.

Net changes in working capital are adjusted in the free cash flow projections to arrive at the free cash flow figure. The business would have to find a way to fund that increase in. You need to buy an new ice cooler capital expense to stock more ice.

O The increase in currents assets such as accounts receivables or inventory would lead to lower cash flow then Net. This is basically what. If the change in.

Learn How Our Reverse Dcf Model Works

How Changes To The Corporate Tax Code Could Impact Business Valuations Stout

Jae Jun Blog Changes In Working Capital And Owner Earnings The Complete Guide Talkmarkets

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Free Cash Flow To Firm Fcff Formulas Definition Example

Non Cash Working Capital A Critical Component Of Valuation And Fcf

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Negative Working Capital Made Easy The Ultimate Guide 2021

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Negative Working Capital Formula And Calculation

Dcf And Pensions Enterprise Or Equity Cash Flow The Footnotes Analyst

Dcf Model Tutorial With Free Excel Business Valuation Net

𝟒 𝐄𝐚𝐬𝐲 𝐒𝐭𝐞𝐩𝐬 𝐟𝐨𝐫 𝐂𝐚𝐥𝐜𝐮𝐥𝐚𝐭𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞s 𝐢𝐧 𝐍𝐞𝐭 𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 Accounting Drive

How To Calculate Change In Working Capital Detailed Analysis Iifpia

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital From A Metric To The Valuation Of A Firm