putnam county property tax assessor

Go to County website. Property tax forms - Exemptions.

110 S State Road 19 Palatka Fl 32177 Palatka Florida Palatka Florida

An advantage of our website is forms farm discount personal property and business personal property assessment forms are available available 24 hours a day seven days a week.

. Find My Tax Assessor. Putnam County Property Records are real estate documents that contain information related to real property in Putnam County New York. Public Property Records provide information on homes land or commercial properties including titles mortgages property.

Enter Taxpayer Account Number. Putnam County Property Appraiser In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and taxpayers. Duties of this office.

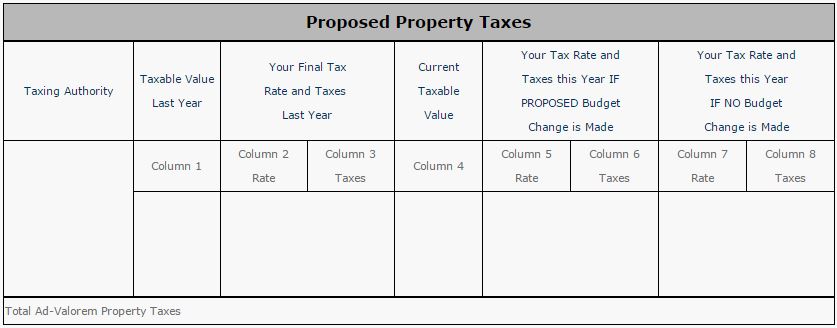

The office maintains the Towns tax maps and data about all properties including ownership and size of all buildings. The tax rates are expressed as dollars per 100 of assessed value therefore the tax amount is already divided by 100 in order to obtain the correct value. The three main functions of the office are to discover list and value all property.

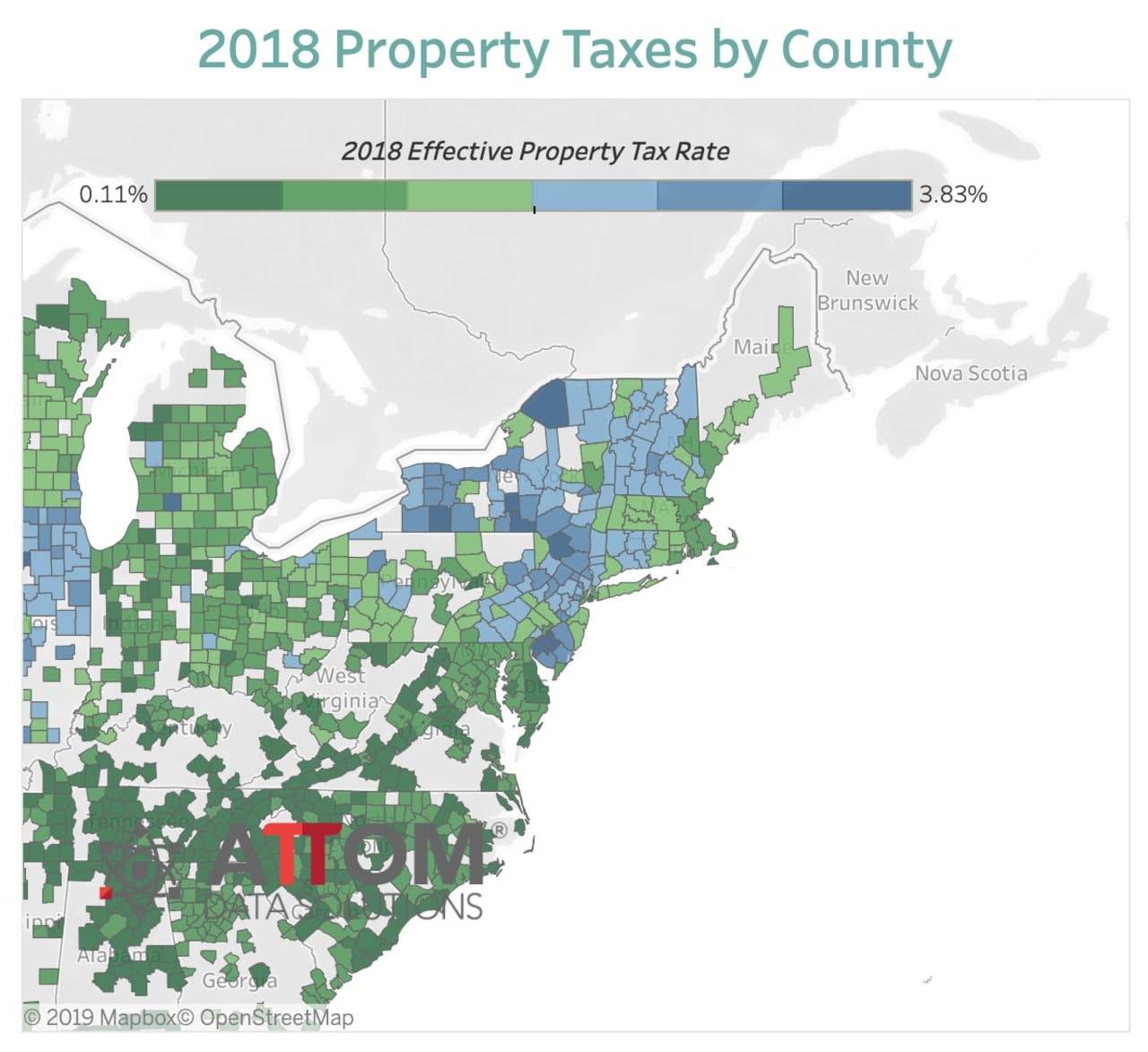

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. NETR Online Putnam Putnam Public Records Search Putnam Records Putnam Property Tax Tennessee Property Search Tennessee Assessor. The information contained herein reflects the values established in the Preliminary tax digest.

For use in Putnam County Only. Beverly Carter CFE FCRM Records Management Liaison Officer beverlycarterputnam-flgov. Set levy rates for property taxes.

Links are provided at the bottom of this page for the counties not included here which are Chester Davidson Hamilton Hickman Knox. Online Property Tax Payment Enter a search argument and select the search button. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Data on this site exists for 85 of Tennessees 95 counties. We can look that information up for you or you can contact the Assessors Office for that information.

See our Municipal Profiles for your local assessors mailing address. House Number Low House Number High Street Name. The information presented on this site is used by county Assessors of Property to assess the value of real estate for property tax purposes.

Putnam County Property Records are real estate documents that contain information related to real property in Putnam County Ohio. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services. It is also the office that processes property tax exemptions for veterans elderly blind and disabled persons.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. OFFICE OF REAL PROPERTY 40 Gleneida Ave. Appoint citizens to serve on Boards and Commissions.

Enter Tax Year and Ticket Number and suffix. As your Putnam County Assessor I Gary Warner would like to personally welcome you to my website. Enter Taxpayer Name last first.

You can search our site for a wealth of information on any property in Putnam County. Set the budget for County Government. Putnam County Tennessee includes the cities of Algood Baxter Cookeville and Monterey and is an area rich in both history and leadership.

Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. Putnam County Board of Review and Equalization hearings are held throughout the month of February by appointment only scheduled through the County Commission office. The tax card for your property shows when your house was built.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Base tax is calculated by multiplying the propertys assessed value by all the tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. The goal of the Putnam County Assessors Office is to provide the people of Putnam County with a web site that is easy to use.

Census Bureau American Community Survey 2006-2010. Putnam County Property Tax Inquiry. This enables us to deliver greater services.

This interactive table ranks Tennessees counties by median property tax in dollars percentage of home value and percentage of median income. Notice of Assessments will be. Form number Instructions Form title.

Old Marveled House Palatka House Florida Home Palatka Florida Old Florida

Jeremy Sisto Buys Moden House In Westchester County Dirt Farmhouse Style House Contemporary Farmhouse Spa Style Bathroom

2021 Property Tax Roll Monroe County Tax Collector

Putnam County Tax Assessor S Office

How To Find Tax Delinquent Properties In Your Area Rethority

Property Appraiser Putnam County Florida

The Old Bookworm Book Store Originally A 7 Eleven Ne Corner Of Palm St Johns Palatka Saint Johns Property Records

Property Tax How To Calculate Local Considerations

These Hudson Valley Counties Have Highest Property Tax Rates In Nation New Study Says Ramapo Daily Voice

Trim Notices Property Appraiser

Putnam County Fl Property Search Interactive Gis Map

Sample Property Tax Bill Polk County Tax Collector

Listing Search Form Search For Real Estate Properties Mlsli Com Long Island Real Estate Real Estate Suffolk Property